By Farzad F. Damania, Jennifer L. Howard and Ryan A. Lilley

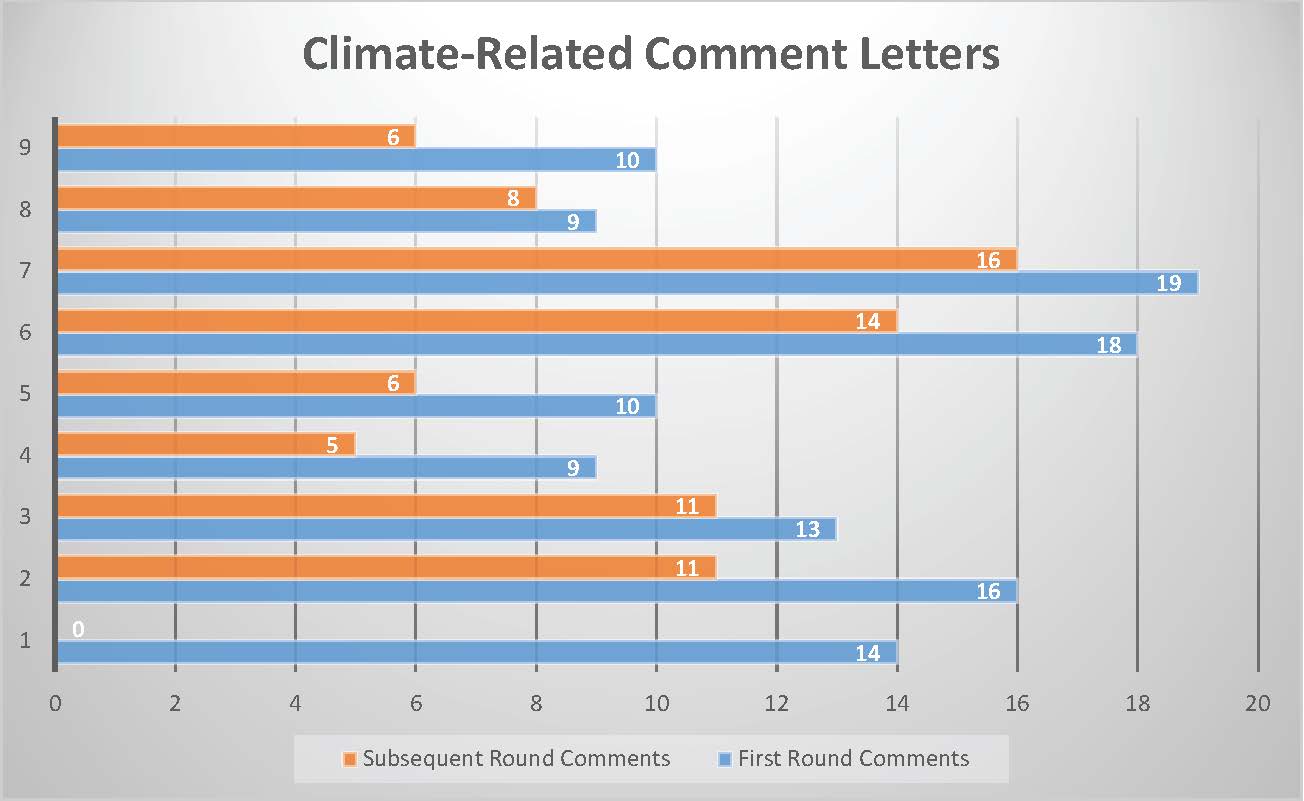

In September 2021, the Securities and Exchange Commission (SEC) provided a sample comment letter that included nine potential climate-related comments the SEC may issue to companies regarding their climate-related disclosure or the absence of such disclosure. The SEC has recently started to release the comment letters and responses. We have reviewed the climate-related comment letters not related to a securities offering through April 24 and summarized our findings below. It appears the SEC initially focused on providing comment letters to larger companies, with 25 companies ranging from $3.7 billion to $1.5 trillion in market capitalization spanning a broad range of industries. Companies received an average of 4.7 first-round comments and 3.1 second-round comments. While less common, certain companies received third-round comments.

Caption: The table indicates frequency of comments issued and subsequent-round comments issued by the SEC for each of the nine sample comments.

Sample Comments and Company Responses

1. "We note that you provided more expansive disclosure in your corporate social responsibility report (CSR report) than you provided in your SEC filings. Please advise us what consideration you gave to providing the same type of climate-related disclosure in your SEC filings as you provided in your CSR report."

The SEC requested information regarding the consideration companies gave to including more expansive information in their CSR reports than in their SEC filings. Responses to this comment generally noted that the companies are following different disclosure requirements for CSR reports and SEC filings and contain confirmations that the companies will continue to monitor and evaluate whether to include additional climate-related information in future SEC filings. There has been no pushback from the SEC to company responses.

2. "Disclose the material effects of transition risks related to climate change that may affect your business, financial condition, and results of operations, such as policy and regulatory changes that could impose operational and compliance burdens, market trends that may alter business opportunities, credit risks, or technological changes."

The SEC requested information regarding the transition risks related to climate disclosure that may affect a company’s business. Initial responses that respectfully denied the potential climate change impact on the company’s business or that stated no material effects have been identified received additional comments from the SEC. Four companies did not receive such additional requests and each of the companies that avoided multiple rounds of comments acknowledged the potential impact of transition risks on their businesses.

In response to subsequent-round comments from the SEC, most companies provided greater detail as to what they consider to be transition risks and how their materiality determinations were made. For example, one company stated that it considers transition risks related to climate change to include "potential policy and regulatory changes, technology changes, market trends, stakeholder views and credit risks." This company also stated that it considers materiality as the "substantial likelihood that the information, including transition and other risks, would have been viewed by the reasonable investor as having significantly altered the total mix of information made available." The company then provided a detailed analysis of the materiality of certain transition risks facing the company and concluded that such transition risks have not yet been material to the company.

While there is no sure way to avoid multiple rounds of comments from the SEC, companies should consider defining transition risks and materiality and providing a detailed analysis that supports their conclusions regarding materiality.

3. "There have been significant developments in federal and state legislation and regulation and international accords regarding climate change that you have not discussed in your filing. Disclose any material litigation risks related to climate change and explain the potential impact to the company."

The SEC requested information related to material, climate-related litigation risks and their potential impact to certain companies. Companies that denied awareness of any material, climate-related risks in their initial responses received additional comments from the SEC.

In responding to second- or third-round comments, companies provided greater detail on how they came to their materiality determination. In particular, certain companies defined material litigation and cited the materiality requirement in Item 105 of Regulation S-K. For example, one company stated that material lawsuits are those that involve amount greater than or equal to 1 percent of its consolidated profits before income taxes and stated that there have been no climate-related lawsuits based on this measurement. Additionally, this company provided a description of the considerations that the company took into account when making its materiality determination, including the likelihood of climate-related lawsuits alleging contribution to climate change in relation to their compliance with environmental laws and the prevalence of such lawsuits currently and historically.

Companies may be able to avoid subsequent rounds of comments from the SEC by providing detail as to what they consider material litigation risks, their processes for identifying material litigation risks and citing SEC guidance on materiality in explaining their decision whether to disclose such risks in the SEC filings.

4. "Please revise your disclosure to identify material pending or existing climate change-related legislation, regulations, and international accords and describe any material effect on your business, financial condition, and results of operations."

Some companies received comment letters requesting disclosure regarding the impact of climate-related developments in federal and state legislation and regulation and international accords. Companies took varying approaches to this comment. Some made broad statements noting that while there have been developments in legislation, regulation, and international accords, no developments have occurred that would be considered material and necessitate such disclosure in the company's SEC filings. Other companies identified specific facts, such as the company's alignment with the Paris Agreement and strategies implemented to reach the company’s goals. A little over half of the companies responding to this comment drew requests for additional information from the SEC. A mere commitment to environmental sustainability was not enough on its own to avoid subsequent follow-up from the SEC on this comment.

Companies responding to multiple rounds of comments described their processes for identifying climate change-related legislation, regulations, or international accords that could materially impact their businesses, along with the related factors such companies consider for materiality determinations related to climate change-related legislation, regulations, or international accords.

To avoid receiving subsequent rounds of comments, companies should consider getting ahead with their climate disclosures by including risk disclosures that specifically reference the potential for legislative and regulatory changes to impact their businesses, financial condition and results of operations.

5. "Revise your disclosure to identify any material past and/or future capital expenditures for climate-related projects. If material, please quantify these expenditures."

The SEC issued comment letters requesting disclosure of any material past and/or future capital expenditures for climate-related projects. Companies that responded to this comment by providing all expenses related to environmental compliance or those expenses that had a positive effect on the environment in their first response avoided second round comments from the SEC. About half of the companies did not provide any support for their conclusion that their businesses did not have any material climate-related capital expenses and received additional comments from the SEC.

To avoid additional rounds of comments from the SEC, companies should consider providing details regarding capital expenditures on projects related to environmental sustainability. Projects that involve new, energy-efficient facilities or pursuing certifications such as the LEED Gold certification, if any, should be included in companies' initial responses. Companies should also consider including the percentage amount of climate-related capital expenditures relative to their consolidated capital expenditures when explaining their determination of materiality for such expenditures.

6. "To the extent material, discuss the indirect consequences of climate-related regulation or business trends, such as the following:

- decreased demand for goods or services that produce significant greenhouse gas emissions or are related to carbon-based energy sources;

- increased demand for goods that result in lower emissions than competing products;

- increased competition to develop innovative new products that result in lower emissions;

- increased demand for generation and transmission of energy from alternative energy sources; and

- any anticipated reputational risks resulting from operations or products that produce material greenhouse gas emissions."

The SEC issued comments related to the indirect consequences of climate-related regulation or business trends such as increased or decreased demand based on a product's carbon footprint. Most companies responded by noting that they had not identified any material indirect consequences of climate-related regulation or business trends that had a material impact on their businesses. However, simply including this statement was not sufficient, and nearly all companies received a second round of comments with a request for more information from the SEC.

Companies responding to subsequent rounds of comments provided detailed support for their determination of materiality, and some also provided metrics such as the percentage of weather-related damages to their property relative to their selling, general and administrative expenses.

To avoid similar SEC comments, companies should consider including disclosure regarding the indirect effects of climate-related regulation and business trends on their businesses in their SEC filings. If companies receive similar SEC comments, they should consider providing detailed support for their materiality determination in their responses to avoid additional comments.

7. "If material, discuss the physical effects of climate change on your operations and results. This disclosure may include the following:

- severity of weather, such as floods, hurricanes, sea levels, arability of farmland, extreme fires, and water availability and quality;

- quantification of material weather-related damages to your property or operations;

- potential for indirect weather-related impacts that have affected or may affect your major customers or suppliers;

- decreased agricultural production capacity in areas affected by drought or other weather-related changes; and

- any weather-related impacts on the cost or availability of insurance."

The SEC issued company-specific comments regarding the physical effects of climate change on operations such as severity of weather, material weather-related damages, decreased agricultural production, etc. Many companies denied the existence of any significant physical effects of climate change on their businesses and the SEC was quick to reissue comments for responses that it viewed as conclusory.

Companies responding to subsequent rounds of comments for information noted the weather-related damages that they experienced in years past relative to total costs and expenses.

To avoid multiple rounds of comments from the SEC, companies should consider acknowledging the potential impact of the physical effects of climate change and consider providing their costs specifically related to damages from extreme weather.

8. "Quantify any material increased compliance costs related to climate change."

The SEC has issued a few comments relating to climate change-related compliance costs. Most companies stated that they did not incur any material climate change-related compliance costs in their initial response. However, many companies received second-round comments and provided data to support their materiality determination. For example, one company noted that its climate change compliance costs have been less than 0.1 percent of its total selling, general and administrative expenses for its last three fiscal years.

To avoid receiving multiple rounds of comments from the SEC for this comment, companies should consider providing detailed descriptions of their processes for determining the materiality of climate-related compliance costs. Additionally, companies that determine such costs are immaterial should consider providing a percentage representation of their climate-related compliance costs relative to certain selling, general and administrative costs or other expense measures.

9. "If material, provide disclosure about your purchase or sale of carbon credits or offsets and any material effects on your business, financial condition, and results of operations."

The SEC issued a few comments relating to the purchase and sale of carbon credits or offsets. In their initial responses, many companies stated that their purchase or sale of carbon credits or offsets were not material to their business. If companies failed to provide any support for this conclusion, the SEC issued subsequent rounds of comments for additional information.

To avoid receiving multiple rounds of SEC comments, companies that purchase and sell carbon credits or offsets should consider providing the amount of carbon credits or offsets purchased or sold. Companies that do not purchase carbon credits or offsets could consider stating that they do not purchase or sell carbon offsets or credits.

Going Forward

In light of the SEC's proposed climate-change disclosure rules (See "SEC Proposes Climate-Related Disclosure Requirements"), we anticipate that the SEC will continue to issue comment letters similar to the comments discussed above. To avoid multiple rounds of comment letters from the SEC, companies should review their disclosures in light of the SEC's focus areas and consider providing as much detail as they can. While there is no sure-fire way to ensure that the SEC will not re-issue comments or issue a second or even third round of comments, there are steps companies can consider taking to reduce their securities compliance costs related to these climate-change comment letters, including the following:

- Gather company-specific climate change data;

- Carefully consider the risks and potential financial and operational impact of climate change;

- Disclose such data and climate-related risks in periodic SEC filings; and

- Provide details for the basis of company decisions related to materiality.

While companies may follow each of these steps and still receive multiple comment rounds from the SEC, companies following these steps may be less likely to receive such comments and will be in a better position to adequately respond to the SEC in their initial responses.

To read the full newsletter, please click here.