Executive Summary

A distressed disposal (Distressed Disposal) under an LMA-based intercreditor agreement1 (ICA) is a powerful restructuring tool. It has the potential to significantly de-lever a business for the benefit of the “in the money” class of lenders (which, for ease of terminology, we will refer to as the “Senior Lenders”).

Yet, unlike similar tools (such as company voluntary arrangements (CVAs), schemes of arrangement and restructuring plans), it receives little press attention. This is for two reasons, each of which should make the process even more appealing for Senior Lenders. The first is that it is a contractual right, requiring no court involvement or recourse to statutory tools. The second is that, based on the limited case law on the process, it has rarely been challenged.

We would expect, however, that with the economic tide turning, the process may well be put to the test more regularly and produce a greater body of case law considering the issues.2

This article suggests some tips for best practices to facilitate a challenge-free process. For ease, the discussion assumes the following:

- that the security package permits a single point of enforcement by way of an English share pledge in respect of an entity that holds the operating companies (which, together, we will refer to as the “Target Group”); and

- that value breaks in the Senior Lenders’ debt.

ICAs and Distressed Disposals – A Brief Introduction

For those unfamiliar with Distressed Disposals and ICAs, below is a brief introduction.

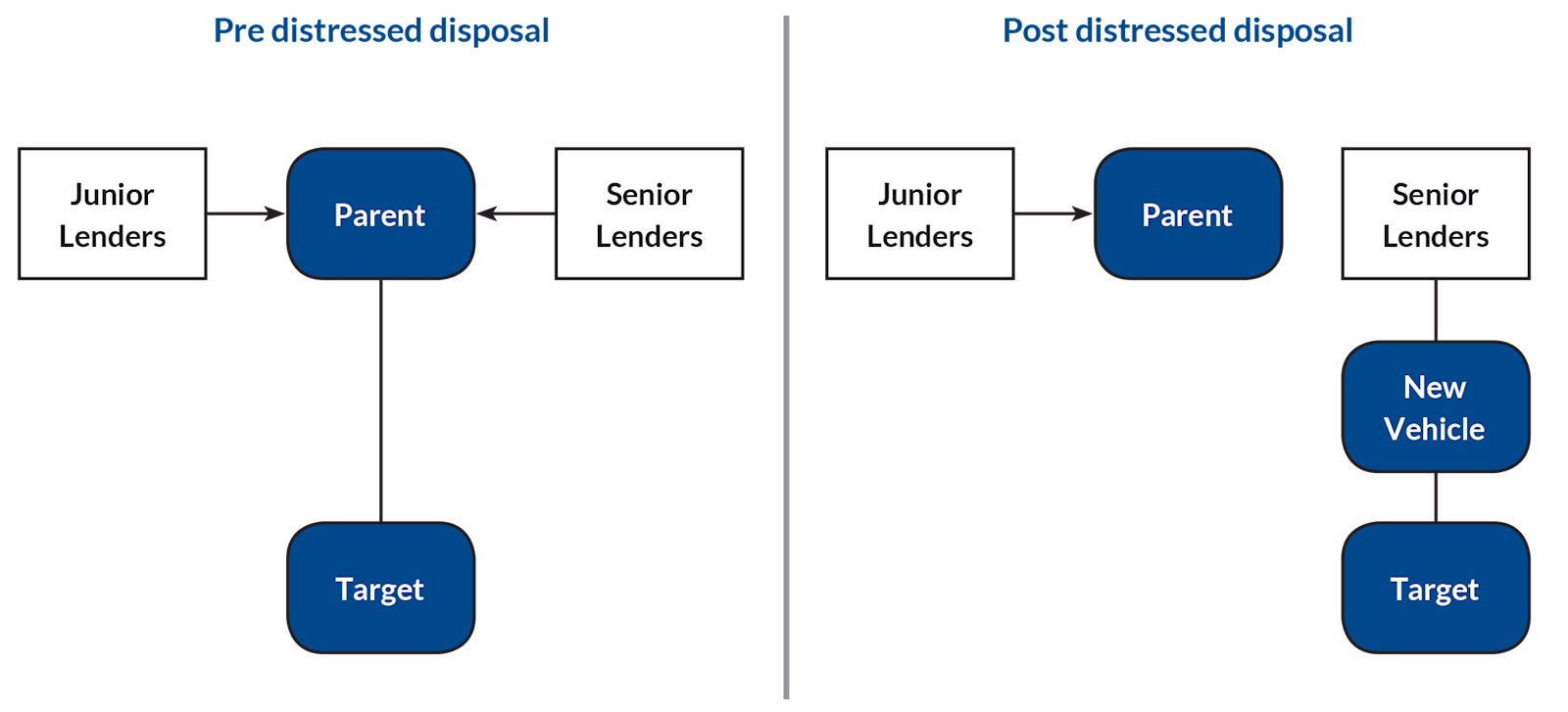

Deleveraging Tool: At its heart, a Distressed Disposal is a deleveraging tool. Senior Lenders may invoke it following an enforcement event to effect a transfer of the Target Group to a newly incorporated entity affiliated to the Senior Lenders. Crucially, the ICA permits release of the Target Group from all liabilities and security – similar in effect to a so-called “pre-pack administration.”

Other creditors of the seller entity (including the mezzanine lenders and intra-group lenders (which, together, we will refer to as the “Junior Lenders”)) will be left with recourse to the seller’s proceeds of sale (and any other assets that the seller might have following the transfer of the Target Group). These are likely to be nominal, leaving the seller with no option but to file for administration.

Parties to an ICA: An ICA governs the relationship amongst the various classes of principal financial creditors to a corporate group (e.g., the Senior Lenders and Junior Lenders). It regulates not only their contractual rights amongst one another, but also their respective entitlements to common security (including the right to enforce and receive distribution of proceeds following enforcement).

The Senior Lenders and Junior Lenders appoint a common security agent and authorise it to take instructions when an enforcement event arises. None of the Senior Lenders or Junior Lenders has a right to take action otherwise than through the security agent.

Instructing Group: A so-called “Instructing Group” (being the majority Senior Lenders while senior indebtedness is outstanding) has the right to instruct the security agent to protect and enforce its rights once an enforcement event occurs. The Junior Lenders are prohibited for the duration from exercising contractual or enforcement rights.3

It is worth noting the obvious: since the ICA is binding only on those creditor classes that have agreed to it, a Distressed Disposal only affects the rights of those creditor classes. Thus, if a broader balance sheet restructuring is required (e.g., lessors, employees, pension deficits or trade creditors), then a CVA, scheme or restructuring plan will be necessary, either in the alternative or in coordination with the Distressed Disposal.

Tips for a Smooth Execution

Distressed Disposals require planning. This is not welcome news when, invariably, the circumstances giving rise to a right to exercise a Distressed Disposal mean that the time period available to avoid an insolvency filing is short. This is particularly so with the prevalence of “cov-lite” financings, where the enforcement event being relied on may be a payment default, as opposed to an early warning breach of financial covenant.

Nevertheless, at a minimum, the following matters will need to be attended to:

- Security Agent: the incumbent security agent should be replaced with a specialist;

- Diligence: lawyers will need to be engaged to review the transaction documents as well as the Target Group’s key commercial contracts;

- Valuation: a specialist accountant will need to be engaged to advise on the value of the Target Group and inform where value breaks; and

- Planning an Accelerated Merger and Acquisition: if the circumstances dictate, the Instructing Group will need to facilitate an accelerated marketing process.

Each of these is discussed briefly below.

Appoint a Successor Security Agent

The security agent is the lynchpin in the process. Its role in executing the transfer of the Target Group and releasing the claims and security exposes it to suit from disgruntled Junior Lenders and shareholders, who may assert that their rights have wrongly been extinguished or devalued. The risk may be exacerbated if some constituents within the Senior Lenders are par lenders and the majority have bought in at a discount. The security agent relies entirely on its contractual protections – it is not cloaked with the statutory powers and protections of an administrator or receiver.

For this reason, it is advisable to resign the incumbent security agent and appoint a successor who is a specialist with experience in enforcement and restructuring processes. This should be done as soon as possible because the security agent will need time to do the following:

- engage its own counsel and review the documentation to understand the steps required to execute on the Instructing Group’s instructions; and

- negotiate any incremental powers and protections (such as additional indemnities, cash cover for a fighting fund and additional contractual protections).

Diligence

A full diligence on the Target Group’s assets and liabilities will need to be conducted. This is not the place to discuss such matters in detail, but suffice it to say that, depending on the Target Group’s industry, there may be regulatory or sanctions issues. There may also be liabilities (e.g., environmental liabilities, pension deficits and employment liabilities) that cannot be released through the Distressed Disposal mechanism. Local lawyers may need to be engaged if the Target Group has operations or assets outside of the United Kingdom.

Valuation

The ICA requires, at a minimum, the security agent to take reasonable care to obtain fair value on a Distressed Disposal. Whilst there might be evidence as to the price at which the debt of the Senior Lenders and Junior Lenders is trading, no security agent properly advised will rely on that alone. It will require specialist guidance as to valuation of the Target Group. The Instructing Group itself will also want reassurance that the transaction is robust and free from challenge.

The ICA is not prescriptive as to the steps that the security agent is required to take to “obtain fair value”, though the following are typical:

- procuring a fairness opinion and/or valuation opinion provided by a duly qualified financial advisor;

- conducting a competitive sales process;

- obtaining a court order; or

- conducting the process at the direction of an administrator, liquidator, receiver or administrative receiver.

If circumstances permit the luxury of a court order or an officer appointment, the security agent’s role will be simplified. However, in most circumstances, there will not be such an option. Below, we consider some issues arising in relation to fairness opinions and competitive sales processes, and look at some English law principles on valuation.

Fairness Opinions: The ICA provides that a fairness opinion should provide that the proceeds received or recovered in connection with the Distressed Disposal are “fair from a financial point of view taking into account all relevant circumstances.”

An important point of reference is likely to be the recovery on the counter-factual, which may be a sale in administration or an asset break-up on an accelerated basis, so the valuation may need to consider that scenario. A financial advisor engaged to provide its opinion may or may not require some market testing. In appropriate circumstances, it may rely on desktop valuations.4

Competitive Sales Process: Undertaking an accelerated marketing process may be an alternative option. To stand up to scrutiny, the process should, to the extent practicable, include the following:

- a sensible universe of parties to invite to bid (preferably including industry specialists);

- sufficient time for interested parties to consider the opportunity and conduct diligence; and

- a management team on hand to provide assistance (i.e., prepare an information memorandum and answer questions).

Non-cash consideration (if permitted by the ICA) should be subject to valuation by a financial advisor. Although there is no statutory basis in English law for credit bidding, it is routinely done, and Senior Lenders are likely to provide consideration in the form of their senior debt.5 Recent case law has also permitted unsecured creditors to credit bid their unsecured claim.6

English Case Law on Valuation: Although the case law specifically on Distressed Disposals is limited, there is case law on valuation in other contexts:

- In the context of restructuring plans, the UK High Court has made it clear that it is reluctant to entertain gratuitous “valuation fights.” “[I]t is obviously important that the potential utility of Part 26A is not undermined by lengthy valuation disputes…”7

- In the context of the common law duty of mortgagees, the case law should be persuasive, since the ICA drafting has borrowed from it. A mortgagee is permitted a margin of error when assessing market value, and it has been held that it will only be liable if the conduct is “plainly on the wrong side of the line.” Further, it has been held that, where commercial parties have negotiated, in complex documents, the duties that the security agent owes to lenders on enforcement, the court will give effect to the parties’ intentions (and not impose more onerous duties) in delineating the scope of the trustee’s duties.8

- In the context of appropriation of financial collateral under the Financial Collateral Arrangements (No. 2) Regulations 2003 (FCAR), the UK High Court has held that the collateral taker’s obligation is limited to complying with the FCAR in establishing that the method of valuation is reasonable.9

Conclusion

With the era of cheap credit apparently at an end, it is expected that lenders will be looking for avenues to preserve value. Distressed Disposals under an ICA should be included in the mix of options available. It is a powerful tool, but early preparation is required.