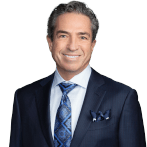

In a Citywealth article on the importance of wealth management and estate planning, Partner Joshua Rubenstein, National Chair of Katten's Private Wealth Department, discussed the importance of being ready in case of unforeseen circumstances. The article focused specifically on the event of a sudden death, using the real-life case of a recently deceased tech entrepreneur as the example. The entrepreneur's passing highlights the critical importance of estate planning and tax management to protect heirs and prevent tax issues. The deceased's estate is further complicated by ongoing legal battles, including a high-profile lawsuit related to his company's sale, which could significantly impact asset distribution. Josh underscores the necessity of contingency planning, stating, "Wills and trusts should always be in place to assure the orderly disposition of assets upon death, even if actuarily the client is not likely to die for many decades. And there should be "wipeout" bequests and designations of successor executors and trustees in place in case immediate family and trusted advisors all die at the same time."

"Estate Planning in the Case of Sudden Demise," Citywealth, October 2, 2024

*Subscription may be required for article access.