By Ryan A. Lilley and Farzad F. Damania

In September 2021, the Securities and Exchange Commission (SEC) provided a sample comment letter, which included nine potential climate-related comments the SEC may issue to companies regarding their climate-related disclosure or absence thereof. We have reviewed and analyzed the climate-related comment letters issued to over 70 companies on a stand-alone basis. Initially, it appeared that the SEC focused exclusively on larger companies with a market capitalization exceeding approximately $3.5 billion. However, during the second half of 2022, the SEC issued comments to companies with market capitalizations as low as approximately $500 million. Additionally, the SEC appears to be issuing significantly more first-round comments per company and about the same number of second-round comments per company. In our initial review of climate-related comment letters issued to 25 companies as of April 2022, the SEC issued 4.7 first-round comments per company. However, the SEC now issues an average of 6.1 first-round comments per company, representing a 30 percent increase. Companies responding to such comment letters continued to receive an average of approximately three second-round comments.

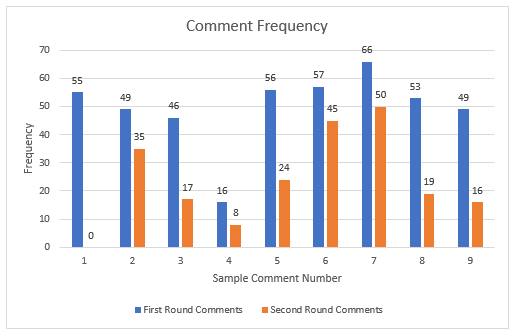

The chart below shows the frequency at which each sample comment has been issued in first- and second-round comment letters:

We note comment frequency for the following three sample comments:

Sample Comment 7: "If material, discuss the physical effects of climate change on your operations and results. This disclosure may include the following:

- severity of weather, such as floods, hurricanes, sea levels, arability of farmland, extreme fires, and water availability and quality;

- quantification of material weather-related damages to your property or operations;

- potential for indirect weather-related impacts that have affected or may affect your major customers or suppliers;

- decreased agricultural production capacity in areas affected by drought or other weather-related changes; and

- any weather-related impacts on the cost or availability of insurance."

Sample Comment 7 is the most likely comment to be issued in the first round with over 90 percent of companies receiving such comment. Additionally, 76 percent of first-round recipients received follow-up inquiries.

Sample Comment 6: "To the extent material, discuss the indirect consequences of climate-related regulation or business trends, such as the following:

- decreased demand for goods or services that produce significant greenhouse gas emissions or are related to carbon-based energy sources;

- increased demand for goods that result in lower emissions than competing products;

- increased competition to develop innovative new products that result in lower emissions;

- increased demand for generation and transmission of energy from alternative energy sources; and

- any anticipated reputational risks resulting from operations or products that produce material greenhouse gas emissions."

Sample Comment 6 is the second most likely first-round comment to be issued with 78 percent of companies receiving it and the most likely comment to get follow-up questions at a rate of 79 percent.

Sample Comment 1: "We note that you provided more expansive disclosure in your corporate social responsibility report (CSR report) than you provided in your SEC filings. Please advise us what consideration you gave to providing the same type of climate-related disclosure in your SEC filings as you provided in your CSR report."

Sample Comment 1 is the fourth most likely comment to be issued in the first round but is notable because Companies appear to be least at-risk to draw additional comments based on their response to Sample Comment 1. Of the comment letters we reviewed, 55 companies were issued Sample Comment 1 and no companies were reissued Sample Comment 1.

Of the 73 companies for which we reviewed comment letters, only four companies avoided second-round comments altogether. These four companies acknowledged climate-related risk to their companies, defined terms such as "materiality," supported conclusory statements and cited relevant public filings whenever possible. While there can be no assurance that the SEC will not issue additional rounds of comments, companies that provide detailed analysis and support for conclusory statements appear to be the least likely to draw additional rounds of comments.

Going Forward

Starting in the first quarter of 2022, climate disclosure has been among the three most frequent topics drawing comment letters with respect to Form 10-K and Form 10-Q filings. In light of the SEC's proposed climate-change disclosure rules (see SEC Proposes Climate-Related Disclosure Requirements), we anticipate that the SEC will continue to issue comment letters similar to the comment letters discussed above. To avoid multiple rounds of comment letters from the SEC, companies should review their disclosures in light of the SEC's focus areas and consider providing as much detail as they can. While there is no sure-fire way to ensure that the SEC will not re-issue comments or issue a second or even third round of comments, there are steps companies can consider taking to reduce their securities compliance costs related to these climate-change comment letters, including the following:

- gathering company-specific climate change data;

- carefully considering the risks and potential financial and operational impact of climate change;

- disclosing such data and climate-related risks in periodic SEC filings; and

- providing details for the basis of company decisions related to materiality.

While companies may take each of these steps and still receive multiple comment rounds from the SEC, companies following these steps may be less likely to receive such comments and will be in a better position to adequately respond to the SEC.

For additional insight into climate-related comment letters, please see our initial review of the SEC's comment letters.

To read the full newsletter, please click here.