Executive Summary

Investors in LMA-based intercreditor agreements1 (ICA) should be reassured by the commercial approach recently taken by the High Court in construing the "Distressed Disposal" provisions (DD Provisions).

Galapagos Bidco S.A.R.L. v Dr Frank Kebekus and others [2023] EWHC 1931 (Ch) (Galapagos) is the first judicial determination of DD Provisions in over a decade2. The decision is welcome for confirming that they do precisely what they say on the proverbial tin. Many Distressed Disposals that have been executed in accordance with "first principles" and reliance on the plain English of the DD Provisions will be safe from challenge. The decision also paves the way for confident execution of future Distressed Disposals.

In April, we published our thought piece, "Deleveraging through the LMA Intercreditor Distressed Disposal: How to Navigate a Challenge-Free Process". This advisory confirms and further elaborates some of those points.

Issues settled by Galapagos

1. Payment in cash is the same as if made by way of set-off.

(Thus, where DD Provisions provide that consideration (Consideration) for a Distressed Disposal shall be in "cash (or substantially in cash)", traditional money tender is not required.)

2. In particular, "cash" refers to the Consideration for the Distressed Disposal (as opposed to the recipient's use of the Consideration). A purchaser's promise to pay the purchase price is sufficient Consideration.

(Thus, there is nothing in the decision by a recipient (or Reinvesting Noteholder) of the Consideration to reinvest it by subscribing for securities (or New Notes) in the purchaser that would characterise the Consideration as deferred consideration, in breach of the DD Provisions.)

3. Set-off can be consummated by way of a "settlement confirmation" executed by the Security Agent.

4. Set-off requires no valuation.

(Thus, there is no requirement to value New Notes. The fact that New Notes were issued by the purchaser on entirely different terms to the securities held by the Reinvesting Noteholders in the principal Galapagos debtor entity (Bidco) was irrelevant. It is for the Reinvesting Noteholders to decide how to apply the consideration.)

5. An otherwise unconditional release of claims and security in the incumbent debtor is not recharacterised as conditional simply because some or all of the secured creditors choose to reinvest the Consideration in the purchaser's secured securities.

(Thus, the court held that the Reinvesting Noteholders subscription for New Notes secured on the assets of the purchasing entity did not affect the unconditionality of the release of security in the Bidco and its group (Galapagos Group).

6. The Security Agent must comply with the DD Provisions (as further detailed below) regardless of whether value breaks in the Instructing Group (as defined below).

Background

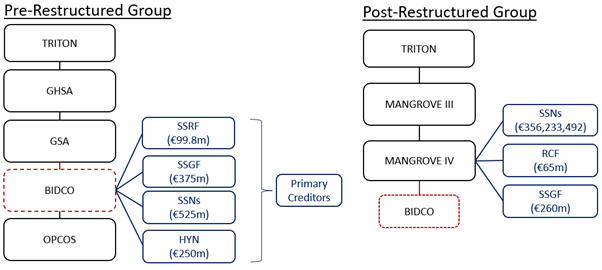

Following the Galapagos Group's prolonged period of financial difficulty, a default constituting a "Distressed Disposal" event occurred under the ICA. Under instructions of the most senior group of creditors in Bidco (Instructing Group), the Security Agent engaged advisors to market Bidco. The only bidder to emerge, and whose bid for €424,631,585 was ultimately accepted, was "Mangrove IV" (together with its affiliates, Mangrove). Mangrove was indirectly owned by Triton, which was also the original sponsor of the Galapagos Group.

As part of the restructuring support agreement leading to the Distressed Disposal, Triton committed €140 million of new equity that was partly used to repay the SSRF and SSGF. Triton also further provided an amount of €24.8 million by way of SSRF to ensure Bidco had sufficient working capital to complete the restructuring.

The pre-restructured and post-restructured capital structures are set out below:

The Security Agent issued a settlement confirmation that set off the subscription price (in an amount of €274,676,540) of the New Notes, pro tanto with the Consideration due to the Reinvesting Noteholders. The Security Agent applied the remaining Consideration (€149,955,045) towards repayment of the Galapagos Group's liabilities to the Primary Creditors in the order of priority mandated by the distribution waterfall in the ICA. The Security Agent also released all liabilities and associated security owed to the Primary Creditors by exercising its powers under clause 17 of the ICA.

Bidco was therefore debt-free and free of encumbrances at the point of acquisition by Mangrove. The Distressed Disposal closed on 9 October 2019.

The central issue before the Court was whether the Distressed Disposal had been executed in accordance with the DD Provisions under the ICA. One of the Galapagos Group's €250 million high yield noteholders, Signal (HYN), sought a declaration that it was ineffective.

Under the ICA, the HYN's rights, including rights on enforcement, were subordinated in all respects to the other Primary Creditors. It was common ground that the HYN was deeply out of the money.

Distressed Disposal Provisions

The DD Provisions provided that a Distressed Disposal could only be affected if each of the following conditions (Conditions) were satisfied:

- The proceeds of the Distressed Disposal must be in cash, or substantially in cash. (Requirement A);

- Creditors' claims and security against Galapagos Group must be unconditionally released and discharged (Requirement B); and

- The Distressed Disposal, which must be made by way of (i) public auction or (ii) a financial advisers' opinion that the Distressed Disposal was fair from a financial point of view, should be obtained (Requirement C).

The HYN Arguments and the Court's Decision

The HYN argued that the Distressed Disposal should be set aside due to failure to comply with Requirement A and Requirement B. Specifically, it argued that:

- Mangrove's Consideration for the purchase of Bidco was not "in cash (or substantially in cash)" and thus in breach of Requirement A. It was common ground that a substantial part of Mangrove IV's payment was made by way of set-off.

- The ICA's requirement that the Distressed Disposal effect an unconditional release of all the Primary Creditors’ claims and security against the Galapagos Group, concurrent with the Distressed Disposal, was ineffective on the basis that the Reinvesting Noteholders elected to reinvest in the New Notes on secured terms.

- It was common ground that Requirement C was satisfied.

There was a third issue argued by the Instructing Group that the Conditions were not required to be satisfied, since the HYN were "out of the money". Ultimately, this did not need to be decided, as the Court found against HYN on Requirement A and Requirement B. The court held against the Instructing Group on this point.

Requirement A

The Court held that Requirement A was satisfied on the basis that the Consideration was identified and valued in cash in the purchase agreement (SPA). The fact that the Reinvesting Noteholders decided to reinvest some of the Consideration (that they were entitled to receive under the waterfall in the ICA) in the New Notes did not mean that the New Notes formed part of the Consideration to purchase Bidco.

The judge said that the real purpose of Requirement A is to ensure that the proceeds of the Distressed Disposal are identified and valued in cash, thereby facilitating the reliability of a Financial Adviser's opinion that the price is fair and enabling it to compare competing bids. Each would be more difficult to achieve if more than an insubstantial part of the consideration took the form of a non-cash instrument or other payment in kind, where the inherent value of which may be uncertain.

Thus, there is nothing in Mangrove's promise to pay the purchase price in cash that could be regarded as "deferred consideration", in breach of the obligation to pay in cash. Mangrove's promise to pay is separate and distinct from the decision of the Reinvesting Noteholders as to how to apply it – e.g., in subscribing for New Notes in Mangrove.

The Security Agent effected the set-off by entering a settlement confirmation with Mangrove. This confirmed that its obligation to pay Mangrove €274,676,540 on behalf of the Reinvesting Noteholders would be discharged by way of set-off against Mangrove's obligation to pay the same proportion of the consideration to the Security Agent under the SPA to those Reinvesting Noteholders. The remaining amount of the purchase price (€149,955,045) was then to be distributed by the Security Agent in accordance with the ICA's distribution waterfall.

The court accepted without argument that set-off can be constituted by way of a settlement confirmation that settles two distinct but related obligations. In this case, those obligations were:

- Mangrove's obligation under the ICA waterfall to pay creditors the Consideration for the Distressed Disposal on the one hand, against

- The Reinvesting Noteholders' obligation to pay Mangrove subscription amounts in respect of the New Notes to capitalise the restructured business.

Requirement B

The court agreed with the Security Agent's analysis that a deed of release it executed concurrently with the sale documents satisfied Requirement B. The deed of release operated to release the claims of all the Primary Creditors in respect of the original debt. The effect of these provisions was that the release and discharge effected by the deed of release and closing under the SPA occurred at the same time, and were therefore effective to comply with the concurrence requirements of Requirement B. It was the Court's view that an alternative finding would impose a "highly significant restriction on the rights of senior creditors by a side-wind".

Conclusion

Security agents now have confidence that a Distressed Disposal of the type undertaken by the parties in the Galapagos transaction – and which is typical of these transactions – will be effective.

In addition, security agents can now defend their approach to follow to the letter the Distressed Disposal provisions to ensure that fair value is achieved, regardless of whether value breaks in the Instructing Group.