Click here for the 2025 Year-End Estate Planning Table of Contents

----------------------------------------------------------------------------------

The One Big Beautiful Bill Act (OBBBA), Pub. L. No. 119-21, enacted on July 4, 2025, marks a sweeping overhaul of the United States Internal Revenue Code of 1986 (Code). Fulfilling a major campaign promise of the Trump Administration, the OBBBA extends, expands, and makes permanent several key provisions of the Tax Cuts and Jobs Act of 2017 (TCJA) that were previously set to expire at the end of 2025. In addition, the OBBBA introduced new presidential priorities, international tax reforms, and permanent extensions of tax incentives focused on individuals and small businesses, with significant implications for US and foreign individuals, businesses and estate planning strategies.

Below, we highlight the most relevant updates for private wealth clients, incorporating additional insights and planning considerations from recent estate and tax law developments.

Individual Income Tax Changes

- Top Marginal Tax Rate: The 37% top federal income tax rate for individuals is made permanent, preventing the scheduled reversion to the pre-TCJA 39.6% rate in 2026. For tax year 2026, the top tax rate remains 37% for individual single taxpayers with incomes greater than $640,600 ($768,700 for married couples filing jointly). Estates and complex trusts are subject to the top 37% rate with income in excess of $16,000. The capital gains rate structure is also permanently retained, with the 15% rate kicking in at $49,451 for individual single taxpayers ($98,901 for married couples filing jointly) and the 20% rate kicking in at $545,500 for individual single taxpayers ($613,700 for married couples filing jointly).

- Alternative Minimum Tax (AMT): The higher AMT exemption amounts and phase-out thresholds established by the TCJA are made permanent. For tax year 2026, the exemption amount for unmarried individuals is $90,100 and begins to phase out at $500,000 ($140,200 for married couples filing jointly for whom the exemption begins to phase out at $1,000,000). The phase-out threshold will be indexed for inflation beginning in 2027.

- Standard Deduction: The increased standard deduction is permanently extended and enhanced. Taxpayers aged 65 and older receive an additional $6,000 through 2028. The increased standard deduction will be indexed for inflation beginning in 2027.

- Personal Exemption: The personal exemption is permanently repealed.

- Charitable Deductions: The 60% annual gross income (AGI) limitation for cash contributions is made permanent (up from the pre-TCJA 50%). For itemizers, only contributions exceeding 0.5% of AGI are deductible, with special carryforward rules for amounts above the ceiling and below the floor. For taxpayers in the top 37% marginal income tax bracket, the value of charitable deductions is capped at 35%, effectively imposing a 2% tax on otherwise deductible contributions. Non-itemizers may now claim an above-the-line charitable deduction of up to $1,000 (single) or $2,000 (joint). For those wishing to make sizable charitable gifts, consider accelerating to complete in 2025 before these new limitations take effect; non-itemizers, however, should consider holding tight until 2026 to benefit from the new above-the-line charitable deduction.

- State and Local Tax (SALT) Deduction Cap: The cap on SALT deductions increases from $10,000 to $40,000 for 2025-2029, with a phase-out for modified AGI between $500,000 and $600,000. Both the cap and phase-out thresholds increase by 1% annually. The pass-through entity tax (PTET) "workaround" remains available in states that have enacted it.

- Itemized Deduction Limitation: Beginning in 2026, the value of itemized deductions is capped at 35%, creating a 2% tax on itemized deductions for those in the top bracket. The suspension of miscellaneous itemized deductions (e.g., investment management and tax preparation fees) is made permanent.

Gift, Estate and Generation-Skipping Transfer (GST) Tax Exemptions

- Increased Exemptions: Beginning in 2026, the federal estate, gift, and GST tax exemptions are permanently increased to $15 million per taxpayer ($30 million per married couple with portability), indexed for inflation from 2027 (up from $13,990,000 for 2025). This provides expanded opportunities for generational wealth transfer and long-term planning.

Planning Note: With the "permanent" $15 million exemption, federal transfer taxes are now a concern for only the wealthiest of families. For most clients, income tax planning – including basis adjustment at death and the use of non-grantor trusts – will take on greater importance than transfer tax planning. Review existing trust documents with formula clauses, as many credit shelter or GST trusts may no longer provide transfer tax benefits and could even be disadvantageous by denying a basis step-up at the surviving spouse's death.

New and Enhanced Savings Vehicles

- Trump Accounts: The OBBBA introduces "Trump Accounts," a new federal tax-deferred savings vehicle for children, starting in July 2026. Children born between January 1, 2025, and December 31, 2028, with a valid Social Security number, receive a one-time $1,000 government contribution. Contributions by individuals are limited to $5,000 per year (indexed), with employers able to contribute up to $2,500 per year (also indexed), subject to the overall cap. Earnings grow tax-deferred; contributions are after-tax and not deductible. Investments must be in low-cost US index-tracking funds. Distributions are prohibited before age 18. Following age 18, the account starts to look and function much more like a traditional IRA.

- 529 Plan Enhancements: Annual distribution limits from 529 Plans for elementary, secondary or religious school expenses increase to $20,000 (from $10,000) beginning after December 31, 2025. The definition of qualifying expenses is expanded to include a broader range of educational costs, including tuition, materials, tutoring, standardized test fees and educational therapies for students with disabilities.

Business Tax Provisions Affecting Individuals

- Qualified Business Income (QBI) Deduction: The 20% deduction for QBI for noncorporate taxpayers is made permanent, with relaxed phase-in thresholds for specified service businesses and W-2 wages. Taxpayers with at least $1,000 of qualifying income from active trades or businesses are entitled to a minimum deduction of $400, adjusted for inflation from 2027.

- Business Interest Deduction: The interest expense limitation is restored to its more favorable, pre-TCJA form and made permanent. Adjusted Taxable Income (ATI) is now calculated without regard to depreciation, amortization or depletion deductions, allowing greater interest deductibility. However, for tax years after 2025, subpart F income and "net CFC tested income" are excluded from ATI, reducing available interest deductions for US shareholders of foreign corporations.

- Excess Business Loss Limitation: The limitation on excess business losses for noncorporate taxpayers is made permanent, capping deductible losses at $250,000 ($500,000 for joint filers), adjusted for inflation. From 2026, the inflation adjustment baseline resets to 2024. Disallowed losses become net operating losses for future years.

Tax-Favored Investment Provisions

- Qualified Opportunity Zone (QOZ) Program: The QOZ program is indefinitely extended and modified. Existing QOZ designations remain until December 31, 2028. New tracts may be proposed every 10 years, with stricter eligibility. From January 1, 2027, a new incentive structure allows deferral of capital gains reinvested in Qualified Opportunity Funds (QOFs) within 180 days. Deferred gains become taxable at the earlier of sale or the fifth anniversary, with a 10% step-up in basis after five years. No additional step-up is available at seven years. Gains on investments held for 10 years are permanently excluded from tax; after 30 years, basis is stepped up to fair market value. The OBBBA also introduces Qualified Rural Opportunity Funds (QROFs), which require only a 50% basis improvement over 30 months and provide a 30% step-up in basis after five years.

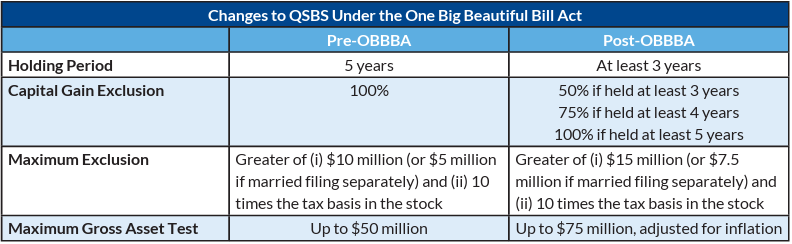

- Qualified Small Business Stock (QSBS) Exclusion: For QSBS acquired after July 4, 2025, the per-issuer gain exclusion cap increases to the greater of $15 million ($7.5 million for married filing separately) or 10x the taxpayer’s basis, indexed for inflation. The minimum holding period for partial exclusions is reduced to three years (50% exclusion), four years (75%), and five years (100%). The gross assets test increases from $50 million to $75 million, also indexed. Core requirements under section 1202 remain unchanged.

Planning Note: The OBBBA's enhancements to QSBS planning – including the higher cap, shorter holding periods for partial exclusions, and the ability to "stack" exclusions using non-grantor trusts – create new opportunities for liquidity and tax efficiency, especially for founders and early investors in venture-backed companies.

Provisions Impacting Not-For-Profit Organizations

- Private Foundations: The 1.39% excise tax on net investment income for private foundations remains unchanged.

- Endowment Tax: Beginning in 2026, private colleges and universities with per-student assets exceeding $750,000 face a graduated excise tax: 4% for assets between $750,000 and $2 million per student, and 8% for assets above $2 million. International students are excluded from the per-student calculation.

- Scholarship Granting Organizations (SGOs): Starting in 2027, a new federal nonrefundable tax credit is available for contributions to 501(c)(3) public charities designated as SGOs. Taxpayers may claim up to $1,700 annually, with a 5-year carryforward. The credit is reduced if a similar state-level credit is claimed.

International Tax Changes

- GILTI and FDII: The OBBBA renames GILTI as "net CFC tested income" (NCTI) and FDII as "foreign-derived deduction eligible income" (FDDEI). The deduction for NCTI is reduced to 40% (from 50%), and for FDDEI to 33.34% (from 37.5%). The portion of foreign income taxes deemed paid increases to 90% (from 80%), but 10% of deemed paid foreign tax credits are disallowed for distributions of previously taxed NCTI. The effective tax rate for both NCTI and FDDEI rises to 14% (from 13.125%).

- Controlled Foreign Corporations (CFCs): The OBBBA restores the rule limiting "downward attribution" of stock for CFC status, reducing the number of foreign corporations treated as CFCs. A new section 951B targets certain foreign-parented groups. The pro rata share rules are modified so that US shareholders may have subpart F or NCTI inclusions if they own CFC stock on any day of the year, not just the last day.

- The Base Erosion and Anti-Abuse Tax (BEAT) Rate and Credits: The BEAT rate is permanently set at 10.5% beginning in 2026, and the pre-2025 rules for BEAT-favored tax credits are retained.

Additional Planning Considerations for Post-OBBBA Planning Era

- For individuals with estates under $15 million and married couples with estates under $30 million, federal transfer taxes are now a low priority, and income tax planning – including basis step-up strategies and the use of non-grantor trusts – should be reviewed.

- Review existing trusts with formula clauses, as many credit shelter or GST trusts may no longer provide transfer tax benefits and could even be disadvantageous by denying a basis step-up at the surviving spouse's death.

- The use of non-grantor trusts may offer income-shifting, enhanced SALT deduction utilization, and increased QSBS exclusion opportunities, but careful structuring and administration are required.

- The OBBBA's changes to the QOZ and QSBS rules create new opportunities for tax-efficient investment and liquidity planning, especially for entrepreneurs and investors in high-growth sectors.

2025 Year-End Estate Planning Advisory Table of Contents:

- 2025–2026 Planning Priorities

- The One Big Beautiful Bill Act: Key Year-End Tax Changes for Private Wealth Clients

- Select Updates Impacting Family Business Owners

- Planning Considerations for the Rest of 2025 and Into 2026

- Select Federal Caselaw Updates

- State of the States

- Relevant International Updates

To download a PDF of the entire advisory, click here.

.PNG)